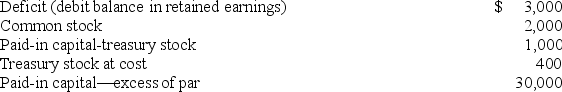

Yellow Enterprises reported the following ($ in 000s) as of December 31, 2018. All accounts have normal balances.  During 2019 ($ in 000s) , net income was $9,000; 25% of the treasury stock was resold for $450; cash dividends declared were $600; cash dividends paid were $500.

During 2019 ($ in 000s) , net income was $9,000; 25% of the treasury stock was resold for $450; cash dividends declared were $600; cash dividends paid were $500.

- What ($ in 000s) was shareholders' equity as of December 31, 2019?

Definitions:

Nonresident Alien

An individual who is not a citizen or a permanent resident of a country but lives in the country for a limited time, often for work or study.

Domestic Corporations

Corporations that are incorporated and operate in the state in which they were formed.

Nonprofit Corporation

A corporation that operates for educational, charitable, social, religious, civic, or humanitarian purposes, rather than to earn a profit.

Shareholders

Individuals or entities that own one or more shares of stock in a corporation, granting them rights to dividends and a say in corporate governance.

Q10: Persoff Industries International has a defined benefit

Q17: How much tax expense on income

Q23: The net assets of a corporation are

Q34: A net pension asset is the excess

Q36: Contingently issuable<br>A)Factored into EPS if the stock

Q58: On December 31, 2017, Rebel Corporation's

Q88: What are the possible components of pension

Q90: On January 1, 2018, M.T. Toombe Mausoleum

Q170: On January 1, 2018, La-Dee-Da Company awarded

Q225: Funded status<br>A)Created only by the passage of