Use I = Increase, D = Decrease, or N = No effect, to indicate the effect on retained earnings for each of the listed transactions.

Definitions:

Periodic LIFO

An inventory valuation method where the last items placed in inventory are the first ones counted as sold, calculated at the end of an accounting period.

Cost of Goods Sold

Represents the direct costs attributable to the production of the goods sold by a company.

Ending Inventory

Ending inventory is the total value of all products, raw materials, and finished goods that are not sold at the end of an accounting period.

LIFO Perpetual

An inventory valuation method where the last items added to inventory are assumed to be the first sold, updated continuously throughout the accounting period.

Q3: If convertible bonds were issued at a

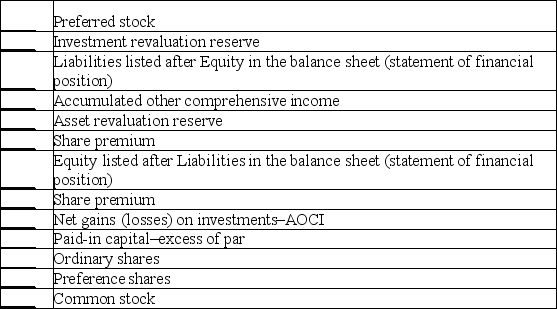

Q6: There almost always is a balance sheet

Q11: ABC declared and paid cash dividends to

Q19: Changes in enacted tax rates that do

Q35: During the current year JET Industries issued

Q60: In 2018, due to a change in

Q91: In December 2018, Kojak Insurance Co. received

Q113: A temporary difference originates in one period

Q158: Which of the following transactions decreases retained

Q188: If the lease begins "at or near