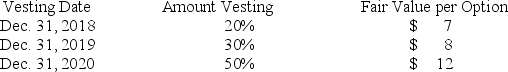

Red Company is a calendar-year U.S. firm with operations in several countries. At January 1, 2018, the company had issued 40,000 executive stock options permitting executives to buy 40,000 shares of stock for $25. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting) . The fair value of the options is estimated as follows:  What is the compensation expense related to the options to be recorded in 2019?

What is the compensation expense related to the options to be recorded in 2019?

Definitions:

Price Floor

A government- or authority-imposed minimum price that can be charged for a good or service to prevent prices from dropping too low.

Equilibrium Price

The price at which the quantity of a good or service demanded by buyers equals the quantity supplied by sellers.

Rationing Mechanism

A system designed to allocate goods or services among interested users, often used when demand exceeds supply.

Discrimination

The unjust or prejudicial treatment of different categories of people or things, especially on the grounds of race, age, or sex.

Q24: Is the variable "percent of a population

Q36: Contingently issuable<br>A)Factored into EPS if the stock

Q72: Which one of the following financial statements

Q84: The projected benefit obligation may be less

Q86: Baldwin Company had 40,000 shares of common

Q88: The compensation associated with restricted stock units

Q120: Popeye Company purchased a machine for $300,000

Q137: The shareholders' equity of Nick Co. includes

Q150: Sales revenue is $100,000. Accounts receivable increased

Q211: During the current year, East Corporation had