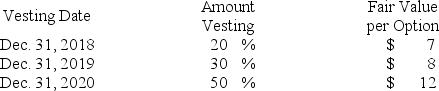

Green Company is a calendar-year U.S. firm with operations in several countries. At January 1, 2018, the company had issued 40,000 executive stock options permitting executives to buy 40,000 shares of stock for $25. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting) . The fair value of the options is estimated as follows:  Assuming Green uses the straight-line method, what is the compensation expense related to the options to be recorded in 2019?

Assuming Green uses the straight-line method, what is the compensation expense related to the options to be recorded in 2019?

Definitions:

Calvin Cycle

A set of chemical reactions that take place in the chloroplasts of photosynthetic organisms to synthesize glucose from carbon dioxide and water, using ATP and NADPH produced in the light reactions.

Rubisco

An enzyme involved in the first major step of carbon fixation, a process by which atmospheric carbon dioxide is converted by plants to energy-rich molecules.

Photorespiration

The process that reduces the efficiency of photosynthesis in C3 plants during hot spells in summer; consumes oxygen and produces carbon dioxide through the degradation of Calvin cycle intermediates.

Rubisco

An enzyme that catalyzes the first step of carbon fixation in the process of photosynthesis.

Q15: Partial balance sheets for ABC Company and

Q25: In a postretirement health care plan, prior

Q54: When a change in accounting principle is

Q57: Pension data for Goldman Company included

Q65: Kinney reported cost of goods sold of

Q72: Why are preferred dividends deducted from net

Q90: Loss-other comprehensive income<br>A)Created only by the passage

Q100: Pension data for the Ben Franklin

Q151: An analyst compiled the following information for

Q166: How do U.S. GAAP and International Financial