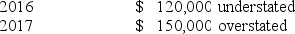

During 2018, P Company discovered that the ending inventories reported on its financial statements were incorrect by the following amounts:  P uses the periodic inventory system to ascertain year-end quantities that are converted to dollar amounts using the FIFO cost method. Prior to any adjustments for these errors and ignoring income taxes, P's retained earnings at January 1, 2018, would be:

P uses the periodic inventory system to ascertain year-end quantities that are converted to dollar amounts using the FIFO cost method. Prior to any adjustments for these errors and ignoring income taxes, P's retained earnings at January 1, 2018, would be:

Definitions:

Gross Method

An accounting method for recording purchases at the full invoice price without deducting any cash discounts offered.

Cash Discounts

A reduction in the amount owed by a customer if payment is made within a specified time frame.

Period-End Adjusting Entry

An accounting record made at the end of an accounting period to allocate income and expenditures to the appropriate period.

Delivery Expense

Costs incurred by a company to transport its products to customers, including freight, shipping, and handling charges.

Q7: Which of the following is not reported

Q41: During its first year of operations, Criswell

Q64: Patterson Company failed to adjust for a

Q72: If a change is made from straight-line

Q74: Partial balance sheets and additional information are

Q94: Which of the following is not a

Q113: Moonland Company's income statement contained the following

Q154: If a stock split occurred, when calculating

Q175: Pickering Company's prepaid insurance was $8,000 at

Q224: A net gain or net loss affects