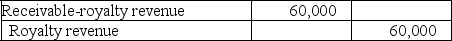

Mattson Company receives royalties on a patent it developed several years ago. Royalties are 5% of net sales, to be received on September 30 for sales from January through June and receivable on March 31 for sales from July through December. The patent rights were distributed on July 1, 2017, and Mattson accrued royalty revenue of $60,000 on December 31, 2017, as follows:  Mattson received royalties of $65,000 on March 31, 2018, and $80,000 on September 30, 2018. In December, 2018, the patent user indicated to Mattson that sales subject to royalties for the second half of 2018 should be $800,000.

Mattson received royalties of $65,000 on March 31, 2018, and $80,000 on September 30, 2018. In December, 2018, the patent user indicated to Mattson that sales subject to royalties for the second half of 2018 should be $800,000.

Required:

(1.) Prepare any journal entries Mattson should record during 2018 related to the royalty revenue.

(2.) What changes should be made to retained earnings relative to these royalties?

Definitions:

Adjusting Journal Entry

An entry made in the accounting records at the end of an accounting period to allocate income and expenditure to the appropriate period.

Deferred Revenue Account

An account on the balance sheet that represents payment received by a company for goods and services not yet delivered or rendered, considered a liability.

Liability Account

A liability account is a financial reporting account that is used to record obligations or debts that a company owes to others, such as loans, accounts payable, or mortgages.

Noninterest-Bearing Notes

These are promissory notes issued at a discount to face value that do not pay periodic interest, with the return to the investor being the difference between the purchase price and the face value at maturity.

Q3: Details of each class of stock must

Q22: C. Good Eyeglasses overstated its inventory by

Q35: During the current year JET Industries issued

Q72: Why are preferred dividends deducted from net

Q108: Partial balance sheets and additional information

Q138: Rampart Inc. recorded the following transaction:

Q138: F Co. declares a 5% stock dividend.

Q142: Financing cash inflow<br>A)Cash collection of a nontrade

Q211: During the current year, East Corporation had

Q223: On January 1, 2018, Marguerite DeVille Co.