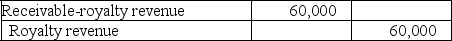

Mattson Company receives royalties on a patent it developed several years ago. Royalties are 5% of net sales, to be received on September 30 for sales from January through June and receivable on March 31 for sales from July through December. The patent rights were distributed on July 1, 2017, and Mattson accrued royalty revenue of $60,000 on December 31, 2017, as follows:  Mattson received royalties of $65,000 on March 31, 2018, and $80,000 on September 30, 2018. In December, 2018, the patent user indicated to Mattson that sales subject to royalties for the second half of 2018 should be $800,000.

Mattson received royalties of $65,000 on March 31, 2018, and $80,000 on September 30, 2018. In December, 2018, the patent user indicated to Mattson that sales subject to royalties for the second half of 2018 should be $800,000.

Required:

(1.) Prepare any journal entries Mattson should record during 2018 related to the royalty revenue.

(2.) What changes should be made to retained earnings relative to these royalties?

Definitions:

Opportunity Cost

The cost of missing out on the second-best option while choosing between two mutually exclusive options in a decision-making process.

Profit

The financial gain realized when the revenue generated from business activities exceeds the expenses, costs, and taxes needed to sustain the activity.

Average Total Cost

The complete expense of manufacturing (encompassing both fixed and variable expenditures) divided by the overall amount of goods produced.

Output

The quantity of goods or services produced by a firm, industry, or economy within a certain period.

Q27: The pension expense includes periodic changes that

Q27: What is the difference between reliability and

Q37: There is not always a clear-cut distinction

Q81: A stock split:<br>A) increases the debt to

Q86: Baldwin Company had 40,000 shares of common

Q94: The accounting records of Westlake Industries

Q113: Moonland Company's income statement contained the following

Q137: The shareholders' equity of Nick Co. includes

Q154: If a stock split occurred, when calculating

Q155: The tax code differentiates between qualified and