Use the following to answer questions

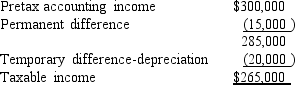

For its first year of operations,Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:

Tringali's tax rate is 40%.Assume that no estimated taxes have been paid.

Tringali's tax rate is 40%.Assume that no estimated taxes have been paid.

-What should Tringali report as income tax payable for its first year of operations?

Definitions:

Leadership Substitute

An approach or factor that makes the leadership style unnecessary or redundant due to its presence, promoting independence in teams.

Self-Leadership Competencies

Refers to the set of skills and behaviors that individuals use to guide their own performance and development proactively.

Situational Leadership Model

A theory suggesting that the most effective leadership style varies depending on the maturity and capability of the followers as well as the complexity of the task.

Team Cohesiveness

The extent to which team members are attracted to the team and motivated to remain in it, contributing to higher levels of group productivity and morale.

Q19: During its first year of operations,Criswell Inc.completed

Q25: In addition to the criteria that must

Q29: Which of the following circumstances creates a

Q46: What is the book value of the

Q56: On January 1,2016,an investor paid $291,000 for

Q57: What is the interest expense on the

Q89: Which of the following statements typifies defined

Q107: A loss contingency should be accrued in

Q137: A reconciliation of pretax financial statement income

Q138: If the lessee and lessor use different