Use the following to answer questions

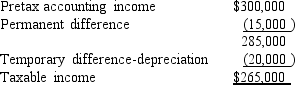

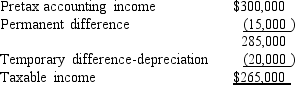

For its first year of operations,Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:

Tringali's tax rate is 40%.Assume that no estimated taxes have been paid.

Tringali's tax rate is 40%.Assume that no estimated taxes have been paid.

-

Tringali's tax rate is 40%.

What should Tringali report as its deferred income tax liability as of the end of its first year of operations?

Definitions:

Qualitative Analysis

In microbiology, identification of bacteria present in a specimen by the appearance of colonies grown on a culture plate.

Substances

Materials or compounds that have a distinct physical presence and chemical composition.

Resident Normal Flora

Bacteria, fungi, and protozoa that have taken up residence either in or on the human body. Some of these organisms neither help nor harm the host and some are beneficial, creating a barrier against pathogens.

Pathogenic

Capable of causing disease when introduced into the body.

Q18: Olsson Corporation received a check from its

Q48: If the leaseback portion of a sale-leaseback

Q90: Amounts withheld from employees in connection with

Q105: When treasury shares are sold at a

Q107: Listed below are five terms followed by

Q121: The valuation allowance account that is used

Q124: EZ,Inc. ,reports pretax accounting income of $400,000,but

Q180: Which of the following is a correct

Q183: Travis Transportation reported a net loss-AOCI in

Q194: Pension data for Matta Corporation include the