Use the following to answer questions

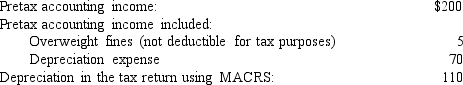

The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars) :

The applicable tax rate is 40%.There are no other temporary or permanent differences.

The applicable tax rate is 40%.There are no other temporary or permanent differences.

-Franklin Freightways experienced ($ in millions) a current:

Definitions:

Retained Earnings

The portion of a company's profits that is kept or retained and not paid out as dividends to shareholders.

Dividends

Payments made by a corporation to its shareholder members. It is the share of profits and retained earnings that the company pays out to its shareholders.

Net Loss

The amount by which a company's total expenses exceed its total revenues, indicating a negative financial performance.

Insurance Expense

The cost incurred from purchasing insurance policies, recognized over the period to which the insurance coverage relates.

Q23: Fox Company received the following reports of

Q72: Louie Company has a defined benefit pension

Q93: On September 1,2016,Red Co. ,issued $48 million

Q102: Fully vested incentive stock options for 100,000

Q121: During the current year,High Corporation had 3

Q141: Rice Inc.had 420 million shares of common

Q151: What is the treasury stock method of

Q153: In terms of business volume,the dominant form

Q185: A company's postretirement health care benefit plan

Q188: Lasagna Corporation has a defined benefit pension