Use the following to answer questions

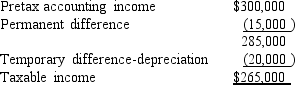

For its first year of operations,Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:

Tringali's tax rate is 40%.Assume that no estimated taxes have been paid.

Tringali's tax rate is 40%.Assume that no estimated taxes have been paid.

-What should Tringali report as income tax payable for its first year of operations?

Definitions:

Transnational

Extending or operating across national boundaries, often used to describe companies, organizations, or activities that are not confined to a single country.

Foreign Subsidiaries

Entities that are owned or controlled by a parent company but are located in a different country.

Joint Ventures

Business arrangements in which two or more parties agree to pool their resources for the purpose of accomplishing a specific task or business activity.

Corporate Codes

Guidelines and policies established by companies to govern behavior, ethics, and practices within their organizations.

Q8: Eagle Company issued 10-year bonds at 96

Q17: Discuss the interest rates used by the

Q23: Under IFRS,a liability that is refinanced after

Q53: The estimated medical costs are expected to

Q59: Listed below are five terms followed by

Q59: During the current year,East Corporation had 2

Q76: An investor purchases a 20-year,$1,000 par value

Q101: Recording a sales-type lease is similar to

Q103: The balance sheet of FIFA Cup Company

Q123: Stock designated as preferred usually has preferential