Use the following to answer questions

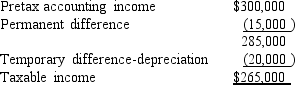

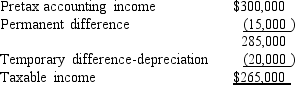

For its first year of operations,Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:

Tringali's tax rate is 40%.Assume that no estimated taxes have been paid.

Tringali's tax rate is 40%.Assume that no estimated taxes have been paid.

-

Tringali's tax rate is 40%.

What should Tringali report as its deferred income tax liability as of the end of its first year of operations?

Definitions:

Transferred

Moved or shifted from one place, person, or entity to another.

Claim in Recoupment

A legal claim made by a defendant in a lawsuit to offset or reduce the amount of damages claimed by the plaintiff, based on related transactions.

Instrument

In legal and financial contexts, a formal document, such as a contract, will, or security, that has a legal effect or is meant to convey rights or obligations.

Original Payee

The initial recipient to whom a financial instrument, such as a check or promissory note, is made payable.

Q8: Eagle Company issued 10-year bonds at 96

Q31: A net operating loss (NOL)carryforward creates a

Q68: The unamortized balance of discount on bonds

Q75: What would be the total interest cost

Q79: What was FRC's pension expense for the

Q112: Which of the following describes defined benefit

Q134: When stock is issued in exchange for

Q134: What is the stated annual rate of

Q137: The postretirement benefit obligation is the:<br>A)Future value

Q145: What is the annual effective interest rate