Use the following to answer questions

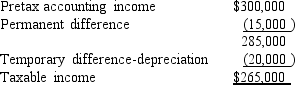

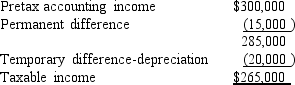

For its first year of operations,Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:

Tringali's tax rate is 40%.Assume that no estimated taxes have been paid.

Tringali's tax rate is 40%.Assume that no estimated taxes have been paid.

-

Tringali's tax rate is 40%.

What should Tringali report as its income tax expense for its first year of operations?

Definitions:

Business Firm

An organization engaged in commercial, industrial, or professional activities, aiming to generate profits.

Work Product

Documents, materials, or information prepared by or for attorneys in anticipation of litigation, protected from disclosure.

Attorney-Client Privilege

A legal principle that keeps communications between a lawyer and their client confidential, encouraging open and honest discourse.

Years

Units of time equal to 365 or 366 days, used in measuring durations and intervals.

Q16: Which of the following indicates the margin

Q21: State and Federal Unemployment Taxes (SUTA and

Q26: Under both U.S.GAAP and IFRS,a lease is

Q31: Amortizing a net loss for pensions will:<br>A)Increase

Q82: Woody Corp.had taxable income of $8,000 in

Q95: The EPBO for a particular employee on

Q118: At what amount would Reagan record the

Q144: Markel Inc.has bonds outstanding during a year

Q144: Burns Company reported $752.4 million in net

Q148: Paid-in capital must consist solely of amounts