Use the following to answer questions

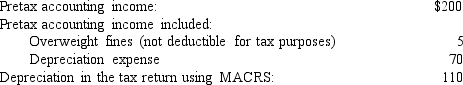

The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars) :

The applicable tax rate is 40%.There are no other temporary or permanent differences.

The applicable tax rate is 40%.There are no other temporary or permanent differences.

-Franklin's taxable income ($ in millions) is:

Definitions:

Manufacturing Overhead

This encompasses all the indirect costs associated with the manufacturing process, including utilities, depreciation, and salaries for non-direct labor.

Variable Cost

Costs that vary directly with the level of production or output, such as raw materials and direct labor expenses.

Fixed Cost Elements

Components of a business's fixed expenses, which can include lease payments, insurance premiums, and salaries, and do not change with production levels.

Differential Costs

The difference in total cost between two alternatives, instrumental in decision-making processes.

Q13: Which of the following creates a deferred

Q24: Bernard Corporation has an unfunded postretirement health

Q35: Listed below are 5 terms followed by

Q58: At times,businesses require advance payments from customers

Q61: A bargain purchase option is defined as

Q77: When the income statement includes discontinued operations,which

Q89: Which of the following statements typifies defined

Q90: Prior service cost is recognized as pension

Q152: Giada Foods reported $940 million in income

Q178: When the service method is used for