Use the following to answer questions

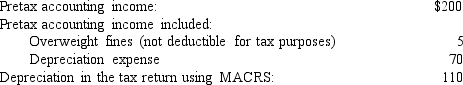

The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars) :

The applicable tax rate is 40%.There are no other temporary or permanent differences.

The applicable tax rate is 40%.There are no other temporary or permanent differences.

-Franklin Freightways experienced ($ in millions) a current:

Definitions:

Compensation Needs

Requirements or demands for payment or recompense, often related to work performed, services rendered, or for restitution in case of loss or injury.

Living Expenses

Refers to the costs associated with daily living, including rent, food, utilities, and transportation.

Feedback

Verbal and nonverbal evidence that a message was received and understood.

Résumé

A document prepared by a job applicant summarizing their job experience, education, and accomplishments.

Q4: Which of the following is not a

Q4: Which of the following is not among

Q33: A statement of comprehensive income does not

Q50: Lender Company provides postretirement health care benefits

Q53: The estimated medical costs are expected to

Q59: On January 1,2016,the board of directors of

Q85: At December 31,2015,Mallory,Inc. ,reported in its balance

Q127: Ignatius Corporation had 7 million shares of

Q139: Premium on bonds payable is a contra

Q149: A reconciliation of pretax financial statement income