Use the following to answer questions

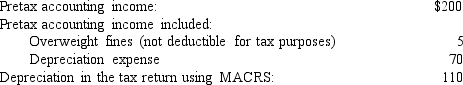

The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars) :

The applicable tax rate is 40%.There are no other temporary or permanent differences.

The applicable tax rate is 40%.There are no other temporary or permanent differences.

-Franklin's balance sheet at the end of its first year would report:

Definitions:

Romantic Partner

An individual with whom one shares a significant, often affectionate or loving, relationship.

Stepparents

Adults who become parents through marrying or partnering with individuals who have children from a previous relationship, rather than biologically.

Realistic Expectations

Understanding and accepting the limits of what is achievable in a given situation, leading to more attainable goals and reduced disappointment.

Family Life

The daily interactions and relationships among members of a household, encompassing various domestic and kinship ties.

Q35: Listed below are 5 terms followed by

Q49: MACRS depreciation typically creates deferred tax liabilities

Q88: In its 2016 annual report to shareholders,Livey

Q96: When a long-term note is given in

Q124: EZ,Inc. ,reports pretax accounting income of $400,000,but

Q136: Treasury stock transactions never increase retained earnings

Q136: Compare and contrast the way leases are

Q136: To help assess the uncertainties that surround

Q143: Compare the concepts of basic and diluted

Q168: What is the service cost to be