In its 2018 annual report to shareholders, Black Inc. disclosed the following information about income taxes.

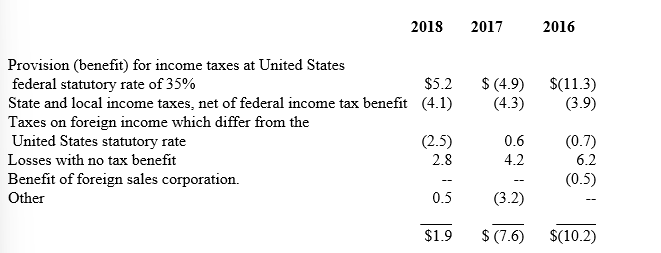

A reconciliation of income taxes computed at the United States federal statutory income tax rate (35%) to the provision (benefit) for income taxes reflected in the Consolidated Statement of Operations for the years ended December 31, 2018, 2017, and 2016 is as follows ($ in millions):

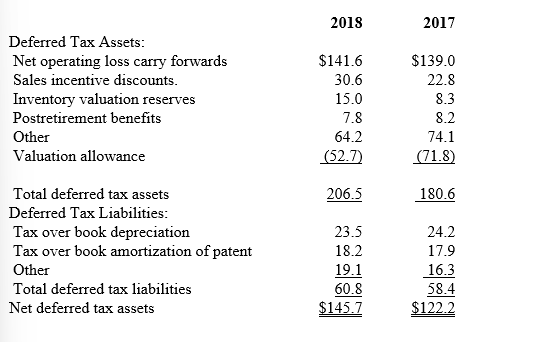

The significant components of the net deferred tax assets at December 31, 2018 and 2017 were as follows ($ in millions):

-Why are the depreciation and patent amortization listed as deferred tax liabilities?

Definitions:

Prepaid Insurance

An asset account that represents insurance paid in advance, which is expensed as it is used or over time.

Accounts Payable

A liability account on a company's balance sheet representing money owed to creditors for goods and services purchased on credit.

Inventory

Items held for sale in the ordinary course of business, as well as materials and components that will be used in the production of goods to be sold.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting the decrease in value over time.

Q17: Use I = Increase,D = Decrease,or N

Q22: Data pertaining to the postretirement health care

Q35: Listed below are 5 terms followed by

Q43: Outstanding common stock is:<br>A)Stock that is performing

Q53: The income statement reports changes in fair

Q67: Careful Consulting Company has an unfunded postretirement

Q77: Which of the following is not a

Q108: Selecting the fair value option for an

Q156: What was the fair value of the

Q159: Interest cost is calculated by multiplying the:<br>A)ABO