Use the following to answer questions

In LMC's 2016 annual report to shareholders,it disclosed the following information about its income taxes:

INCOME TAXES

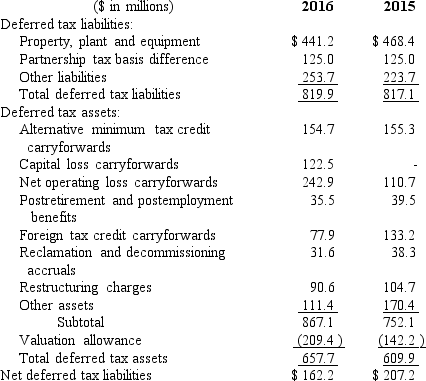

Deferred income taxes reflect the net tax effects of temporary differences between the amounts of assets and liabilities for accounting purposes and the amounts used for income tax purposes.

Significant components of the Company's deferred tax liabilities and assets as of December 31 were as follows:

-Will LMC report $819.9 million as a liability in its balance sheet at December 31,2016? Explain.

Definitions:

Bond Discount

The situation in which a bond is sold for less than its par (face) value, benefiting investors with higher interest rates than current market rates.

Bond Discount

The discrepancy between a bond's nominal value and its market price when the bond is issued at a price below its nominal value.

Liability Valuation

The process of determining the present value of future obligations or debts a company owes.

Bond Indenture Agreement

A legal contract outlining the terms and conditions between a bond issuer and the bondholders, including details of the bond issue and covenants.

Q3: For a loss contingency to be accrued,the

Q13: During the year,L&M Leather Goods sold 1,000,000

Q24: Bernard Corporation has an unfunded postretirement health

Q30: Coy,Inc. ,initially issued 200,000 shares of $1

Q82: Woody Corp.had taxable income of $8,000 in

Q87: Which one of the following assumptions is

Q94: What should Hobson report as income from

Q119: The information that follows pertains to Julia

Q134: What is the stated annual rate of

Q186: Interest cost will:<br>A)Increase the PBO and increase