In LMC's 2018 annual report to shareholders, it disclosed the following information about its income taxes:

INCOME TAXES

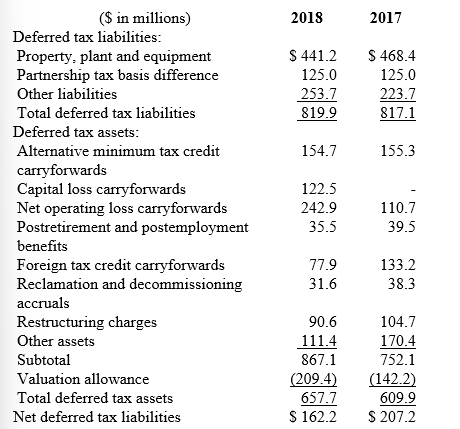

Deferred income taxes reflect the net tax effects of temporary differences between the amounts of assets and liabilities for accounting purposes and the amounts used for income tax purposes.

Significant components of the Company's deferred tax liabilities and assets as of December 31 were as follows:

-Indicate why LMC lists net operating loss carryforwards as a component of deferred tax assets.

Definitions:

Tangible Products

Physical items that can be seen, touched, and used, as opposed to services or digital goods.

Securities

Financial instruments that represent an ownership position in a publicly-traded corporation, a creditor relationship with a governmental body or corporation, or rights to ownership as represented by an option.

Trade Balance

The difference in value between a country's imports and exports over a given period, a component of a country's balance of payments.

Merchandise Exports

Goods produced within a country and sold to customers in another country, contributing to the country's gross domestic product.

Q6: At the end of its first year

Q47: When outstanding bonds are converted into common

Q57: One of the four criteria for a

Q63: On January 1,2016,Bell Co.issued $10 million of

Q70: Use I = Increase,D = Decrease,or N

Q94: Under the new ASU,what amount did SmithCo

Q116: To evaluate the risk and quality of

Q118: What is the effective annual rate of

Q141: In its 2016 annual report to shareholders,Bare

Q144: The components of postretirement benefit expense are