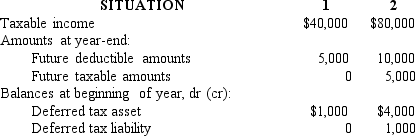

Two independent situations are described below.Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:

The enacted tax rate is 40% for both situations.

Required:

For each situation determine the:

(a. )Income tax payable currently.

(b. )Deferred tax asset - balance at year-end.

(c. )Deferred tax asset change dr or (cr)for the year.

(d. )Deferred tax liability - balance at year-end.

(e. )Deferred tax liability change dr or (cr)for the year.

(f. )Income tax expense for the year.

Definitions:

Operations

Encompasses all the activities involved in the production, selling, and distribution of a company's goods or services.

Competitive Advantage

A unique attribute or capability that allows a company to outperform its competitors, creating greater value for its customers or stakeholders.

Core Competencies

The main strengths or strategic advantages of a company that give it a competitive edge.

Logistical Strengths

The aspects of a company's supply chain that are particularly efficient or effective, helping the company to reduce costs, improve delivery times, or enhance service quality.

Q26: The effect of a change in tax

Q28: How do U.S.GAAP and International Financial Reporting

Q37: Differentiate between the projected benefit obligation,the accumulated

Q74: Which of the following is not an

Q98: Which of the following describes defined benefit

Q110: When the interest payment dates are March

Q122: Ordinarily,the proceeds from the sale of a

Q139: Premium on bonds payable is a contra

Q140: What is the annual stated interest rate

Q162: Revenue and expense items and components of