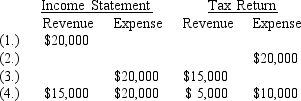

Four independent situations are described below.Each involves future deductible amounts and/or future taxable amounts produced by temporary differences reported first on:

Required:

For each situation,determine the taxable income assuming pretax accounting income is $100,000.Show well-labeled computations.

Definitions:

Day Care Centers

Facilities that provide supervision and care of infants and young children during the daytime, allowing their parents or guardians to work or engage in other activities.

Social Development

The process by which individuals acquire skills, behaviors, and emotions that are considered desirable and appropriate by the society or community they live in.

Cognitive Development

Cognitive development is the study of how children and adults develop thinking and reasoning skills over time, including memory, problem-solving, and decision-making abilities.

Debit Memorandum

An internal document sent from one department to another within a company to notify an adjustment of accounts, usually an increase in expense or a decrease in assets.

Q15: During 2016 Marquis Company was encountering financial

Q29: Amber Inc.is one of the largest pharmacy

Q52: Discuss the key quantitative elements of accounting

Q85: The 2017 sale of half of the

Q90: Poodle Corporation was organized on January 3,2016.The

Q100: A discount on a noninterest-bearing note payable

Q101: In the statement of cash flows,by using

Q116: A company should accrue a loss contingency

Q130: In its 2016 annual report to shareholders,Douglas-Roberts

Q142: Why are differences in reported amounts for