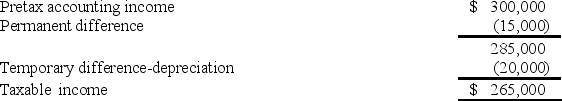

For its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:  Tringali's tax rate is 40%. Assume that no estimated taxes have been paid.

Tringali's tax rate is 40%. Assume that no estimated taxes have been paid.

- What should Tringali report as income tax payable for its first year of operations?

Definitions:

Production Technology

This term refers to the methods and processes used to create goods and services, incorporating tools, machinery, techniques, and knowledge.

Labor Intensive

Describing industries or processes that require a large amount of labor to produce goods or services, often associated with higher employment but lower capital investment.

Alternative Technologies

Refers to the different methods, tools, or systems that can be used as substitutes to achieve the same goal or perform the same function in a process.

Hourly Price

The cost associated with purchasing a good or service for each hour it is used or consumed.

Q33: Prepare a list of how retiree health

Q37: Castillo Company has a defined benefit pension

Q72: Why are preferred dividends deducted from net

Q79: Suppan Service began the year with a

Q126: When accounting for pensions, delayed recognition of

Q177: The Bobo Company leased equipment from Bolinger

Q200: The amortization of a net gain has

Q222: An implicit or imputed rate of interest

Q226: Franconia Leasing leases equipment to a variety

Q239: Pension data for Sewell Corporation include