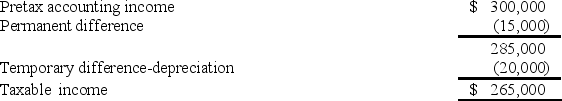

For its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:  Tringali's tax rate is 40%. Assume that no estimated taxes have been paid.

Tringali's tax rate is 40%. Assume that no estimated taxes have been paid.

-What should Tringali report as its deferred income tax liability as of the end of its first year of operations?

Definitions:

Food Chain

A series of organisms each dependent on the next as a source of food, illustrating the flow of energy and nutrients from one organism to another.

Ecological Pyramid

A graphical representation of the relative energy value at each trophic level. See pyramid of biomass and pyramid of energy.

Trophic Levels

The hierarchical levels in an ecosystem, determined by the feeding position of organisms in food chains.

Energy Loss

The reduction in energy as it moves through the trophic levels of an ecosystem; often described in the context of the inefficiency of energy transfer between levels.

Q1: When a property dividend is declared, the

Q49: On January 1, 2018, Gravel Inc. leased

Q84: Titanic Corporation leased executive limos under terms

Q85: On June 30, 2018, Hardy Corporation issued

Q89: Any dividend that is considered to be

Q155: Reliable Corp. had a pretax accounting income

Q166: Conceptually, the service method provides a better

Q168: Retained earnings might be reduced by each

Q192: Assume that at the beginning of the

Q239: B Corp. is a lessee and has