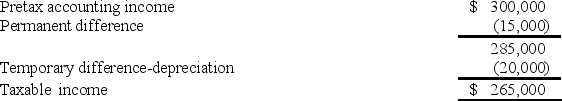

For its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:  Tringali's tax rate is 40%. Assume that no estimated taxes have been paid.

Tringali's tax rate is 40%. Assume that no estimated taxes have been paid.

- What should Tringali report as its income tax expense for its first year of operations?

Definitions:

Expressing

Involves the action of making one's thoughts, feelings, or ideas known to others through speech, writing, or another form of communication.

Negative Feelings

Emotional experiences that are unpleasant or undesirable, such as sadness, anger, frustration, and fear.

Loneliness

An emotional state characterized by feelings of isolation, sadness, and a perceived lack of meaningful social connections.

Married People

Refers to individuals who are legally united in marriage, forming a socially recognized partnership.

Q18: Capital Consulting Company had 400,000 shares of

Q56: Pension benefits and postretirement health benefits typically

Q63: At December 31, 2017, Mongo, Inc., reported

Q73: The appropriate asset value reported in the

Q81: A stock split:<br>A) increases the debt to

Q83: What should Hobson report as net

Q114: Prior service cost is expensed immediately using:<br>A)

Q127: What was the amount of Levi's

Q169: What are the three types of expenses

Q224: A net gain or net loss affects