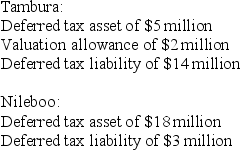

Brady's listing of deferred tax assets and liabilities includes the following for operations in the tax jurisdictions of Tambura and Nileboo:

- Brady files separate tax returns in Tambura and Nileboo. Brady's balance sheet would include the following disclosure of deferred tax assets and liabilities:

Definitions:

Treasury Stock

Shares that were once part of the float and outstanding shares, but were bought back by the company, reducing the amount of stock on the open market.

Common Stock

A type of equity security that represents ownership in a corporation, with rights to vote on corporate matters and receive dividends.

Cash Dividends

Payments made by a company out of its profits to its shareholders, distributed as a fixed amount per share.

Q12: According to GAAP for accounting for income

Q16: ABC Books is the lessor in a

Q40: What nonlease costs might be included as

Q49: On June 27, 2018, Cara Van Travel

Q57: What is the effect of the declaration

Q81: Bumble Bee Co. had taxable income of

Q110: A bargain purchase option is defined as

Q179: The costs that (a) are associated directly

Q201: APBO (postretirement)<br>A)The portion of the EPBO attributed

Q225: Funded status<br>A)Created only by the passage of