In its 2018 annual report to shareholders, Black Inc. disclosed the following information about income taxes.

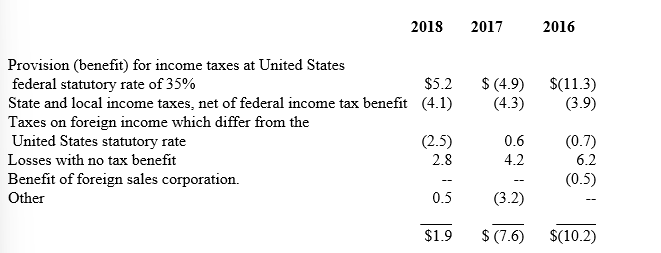

A reconciliation of income taxes computed at the United States federal statutory income tax rate (35%) to the provision (benefit) for income taxes reflected in the Consolidated Statement of Operations for the years ended December 31, 2018, 2017, and 2016 is as follows ($ in millions):

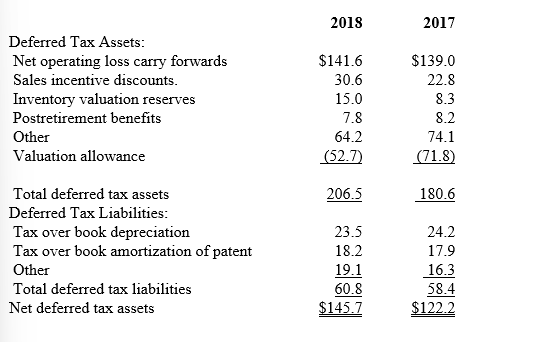

The significant components of the net deferred tax assets at December 31, 2018 and 2017 were as follows ($ in millions):

-Why are the depreciation and patent amortization listed as deferred tax liabilities?

Definitions:

Missionary Selling

A sales technique where the seller promotes their product by educating the customer on its benefits, often without directly pushing for a sale.

Intangible Products

Products that are not physical in nature, such as software, entertainment, or services, offering value through non-physical means.

Insurance

Contract by which the insurer for a fee agrees to reimburse the insured a sum of money if a loss occurs.

Q30: How are deferred tax assets arising from

Q63: On January 1, 2018, Morris Production leased

Q65: United Health Group leased a life support

Q96: Preferred stock is called preferred because it

Q132: C. Worthy Ships initially issued 300,000 shares

Q141: At December 31, 2018, Moonlight Bay Resorts

Q155: Reliable Corp. had a pretax accounting income

Q173: Materiality concept<br>A)No specific assets pledged<br>B)Legal, accounting, printing<br>C)Protection

Q188: If the lease begins "at or near

Q230: Assuming that Auerbach issued the bonds for