In LMC's 2018 annual report to shareholders, it disclosed the following information about its income taxes:

INCOME TAXES

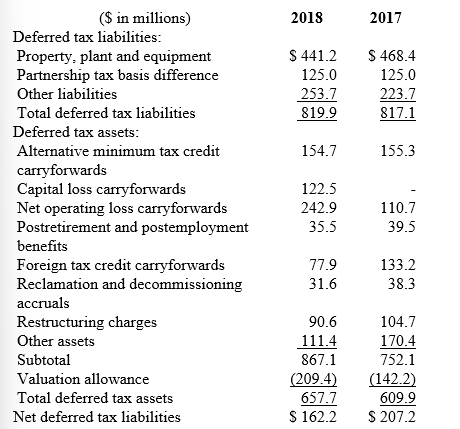

Deferred income taxes reflect the net tax effects of temporary differences between the amounts of assets and liabilities for accounting purposes and the amounts used for income tax purposes.

Significant components of the Company's deferred tax liabilities and assets as of December 31 were as follows:

-Explain why LMC has a $209.4 million valuation allowance for its deferred tax assets.

Definitions:

Signature Requirement

The need for a person's written mark or signature to authorize documents, contracts, or other formal agreements.

Unconditional Promise

denotes a commitment or guarantee made without stipulating any conditions - the promisor must fulfill their obligation, regardless of external circumstances.

Requirements For Negotiability

The legal criteria that a document must meet to be considered negotiable, allowing it to be transferred or endorsed.

Contract Formed

The process of creating a legally binding agreement, requiring offer, acceptance, consideration, and mutual consent among parties.

Q66: Jagadison Co. leases computer equipment to customers

Q83: The lease agreement and related facts indicate

Q89: Which of the following circumstances creates a

Q124: Deferred tax asset<br>A)Is usually a revenue or

Q132: What is the annual effective interest rate

Q142: On September 1, 2018, Red Co., issued

Q193: In an eight-year finance lease, the portion

Q209: <br>Which of the above constitutes the projected

Q219: When the lessee guarantees an estimated residual

Q237: Recording pension expense would usually:<br>A) Increase the