In LMC's 2018 annual report to shareholders, it disclosed the following information about its income taxes:

INCOME TAXES

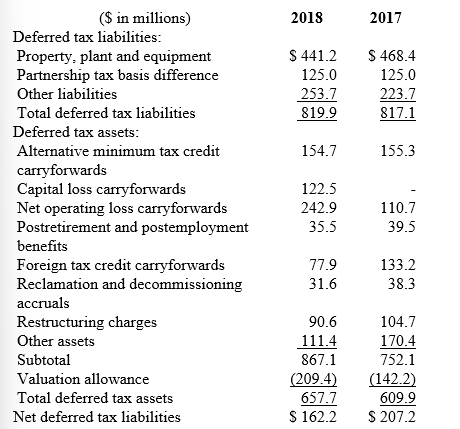

Deferred income taxes reflect the net tax effects of temporary differences between the amounts of assets and liabilities for accounting purposes and the amounts used for income tax purposes.

Significant components of the Company's deferred tax liabilities and assets as of December 31 were as follows:

-Will LMC report $819.9 million as a liability in its balance sheet at December 31, 2018? Explain.

Definitions:

Overhead Rate

The rate at which indirect costs are allocated to produced goods or services.

Direct Labor Dollar

The total cost of wages paid to workers who are directly involved in the production of goods or delivery of services.

Rent Expense

The cost incurred for leasing or renting property or equipment, considered an operating expense in accounting.

Supervision Expense

Supervision expense refers to the cost associated with overseeing and managing workers or operations within a business.

Q33: To raise operating funds, Coyne Incorporated sold

Q43: Before considering a net operating loss carryforward

Q72: Under IFRS, components of other comprehensive income:<br>A)

Q79: Suppan Service began the year with a

Q96: Expenditures currently deducted in the tax return

Q141: Auerbach issued the bonds:<br>A) At par.<br>B) At

Q183: The rate of return on assets indicates:<br>A)

Q200: Charles River Hospital leased medical equipment from

Q206: Assuming no other relevant data exist, what

Q243: Maker Corp. manufactures imaging equipment. Easy Leasing