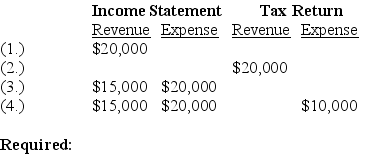

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences reported first on:  For each situation, determine the taxable income assuming pretax accounting income is $100,000. Show well-labeled computations.

For each situation, determine the taxable income assuming pretax accounting income is $100,000. Show well-labeled computations.

Definitions:

Adult Authority

The power or right of adults, often parents or teachers, to make decisions and enforce rules for children or younger individuals.

Instrumental Aggression

Aggressive behavior used as a means of achieving a goal.

Hostile Attribution Bias

The inclination to perceive the actions of others as being driven by malicious intent, even when those actions are unclear or harmless.

Aggressively

A term describing actions or behaviors carried out with force and determination, often without regard for others.

Q43: If the residual value of a leased

Q82: Interest cost is calculated by multiplying the:<br>A)

Q91: Determine the price of a $200,000 bond

Q91: A reconciliation of pretax financial statement income

Q153: The valuation allowance account that is used

Q165: Brown Co. issued $100 million of its

Q166: Conceptually, the service method provides a better

Q171: Clinton Corp. had the following pretax income

Q209: Eagle Company issued 10-year bonds at 96

Q227: On January 1, 2018, Wellburn Corporation leased