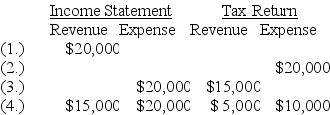

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences reported first on:  Required:

Required:

For each situation, determine the taxable income assuming pretax accounting income is $100,000. Show well-labeled computations.

Definitions:

Annual Interest Tax Shield

The reduction in income taxes a company achieves through deductible interest expenses.

Coupon Rate

The annual interest rate paid by a bond, expressed as a percentage of the bond's face value.

Tax Rate

The percentage at which an individual or corporation is taxed, which can apply to income, capital gains, or property values.

Q11: At December 31, 2017, Mallory, Inc., reported

Q65: United Health Group leased a life support

Q88: On January 1, 2018, Anne Teak Furniture

Q88: What are the possible components of pension

Q90: Temporary difference<br>A)No tax consequences.<br>B)Produces future taxable amounts

Q118: Hillside Excursions issues bonds due in 10

Q137: Earl Lee Riser Alarm Co. issued $10,000

Q157: The tax effect of a net operating

Q204: On January 1, 2018, Solo Inc. issued

Q216: On May 1, 2018, Joe purchased $200,000