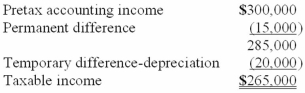

For its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:  Tringali's tax rate is 40%. Assume that no estimated taxes have been paid. What should Tringali report as income tax payable for its first year of operations?

Tringali's tax rate is 40%. Assume that no estimated taxes have been paid. What should Tringali report as income tax payable for its first year of operations?

Definitions:

Mental Age

A concept in developmental psychology that represents the cognitive ability of an individual in comparison to others of a certain chronological age.

Two Years

A time period equivalent to 24 months or approximately 730 days.

Intelligence Quotient

A measure of a person's cognitive abilities and potential, compared to the population, often calculated through standardized testing.

Stern Scale

A measurement or rating system used in a specific contextual framework, which requires further detail to define adequately.

Q15: With pensions, service cost reflects additional benefits

Q17: Assuming that Auerbach issued the bonds for

Q36: A sales-type lease differs from a direct

Q64: Assuming that Auerbach issued the bonds for

Q80: On February 1, 2013, Wolf Inc. issued

Q98: The par value of shares issued is

Q106: Technoid would account for this as:<br>A)A capital

Q146: Share issue costs refer to the costs

Q153: For the issuer of 20-year bonds, the

Q182: In 2011, Winn, Inc., issued $1 par