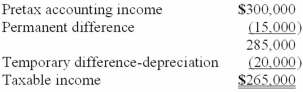

For its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:  Tringali's tax rate is 40%. What should Tringali report as its deferred income tax liability as of the end of its first year of operations?

Tringali's tax rate is 40%. What should Tringali report as its deferred income tax liability as of the end of its first year of operations?

Definitions:

Prior Distribution

Probability distribution for a variable before adjusting for empirical evidence on its likely value.

Black-Litterman Model

A mathematical model for portfolio allocation that incorporates expected returns based on equilibrium, with adjustments from the investor's views.

Treynor-Black Model

A portfolio optimization model that combines the market portfolio with a portfolio of select active bets to maximize portfolio performance under certain conditions.

Security Analysis

The examination and evaluation of various factors affecting the value of securities to make investment recommendations.

Q36: Assuming that Composition had Dividends Payable of

Q55: Diablo Company leased a machine from Juniper

Q74: On October 31, 2013, Simeon Builders borrowed

Q83: What was the average price of the

Q85: Theodore Enterprises had the following pretax income

Q89: Common shareholders usually have all of the

Q97: The net postretirement benefit liability (APBO minus

Q126: A temporary difference originates in one period

Q136: On February 28, 2013, Pujols Industries issued

Q142: Authorized common stock refers to the total