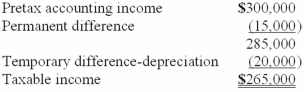

For its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:  Tringali's tax rate is 40%. What should Tringali report as its income tax expense for its first year of operations?

Tringali's tax rate is 40%. What should Tringali report as its income tax expense for its first year of operations?

Definitions:

Cost of Goods Sold

The direct costs attributable to the production of the goods sold in a company, including materials and labor.

Short-Term Portion of Long-Term Debt

The part of a company's long-term debt that is due to be paid within the following twelve months.

5-Year Bank Loan

A financial agreement where a bank lends money to a borrower, to be repaid with interest over a period of five years.

Financial Statements Linkage

The connection and relationship between different financial statements (e.g., balance sheet, income statement, cash flow statement) to assess the financial health of a business.

Q13: The components of postretirement benefit expense are

Q32: The net assets of a corporation are

Q57: Top Foods has an underfunded pension plan.

Q71: When stock is issued in exchange for

Q128: Use I = Increase, D = Decrease,

Q148: Amortizing prior service cost for pension plans

Q150: Cramer Company sold five-year, 8% bonds on

Q158: S Corp. has a rate of return

Q162: The board of directors of Capstone Inc.

Q184: A statement of comprehensive income does not