In its 2018 annual report to shareholders, Black Inc. disclosed the following information about income taxes.

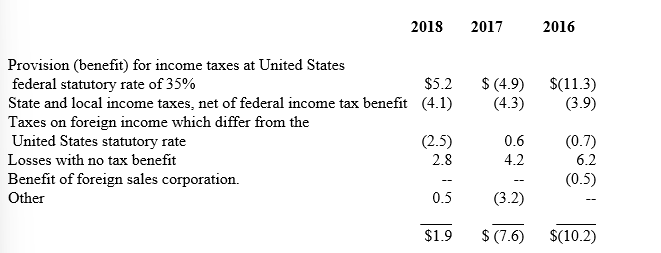

A reconciliation of income taxes computed at the United States federal statutory income tax rate (35%) to the provision (benefit) for income taxes reflected in the Consolidated Statement of Operations for the years ended December 31, 2018, 2017, and 2016 is as follows ($ in millions):

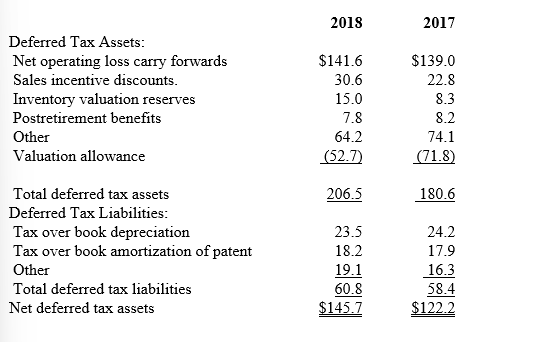

The significant components of the net deferred tax assets at December 31, 2018 and 2017 were as follows ($ in millions):

-Why are the depreciation and patent amortization listed as deferred tax liabilities?

Definitions:

Culture

Culture refers to the shared beliefs, norms, behaviors, and symbols within a group, organization, or society that shape members' worldviews and practices.

Terminal Values

Reflect a person’s preferences concerning the “ends” to be achieved.

Instrumental Values

Instrumental values reflect a person’s beliefs about the means to achieve desired ends.

Uncertainty Avoidance

A cultural dimension that describes the degree to which members of a society attempt to cope with anxiety by minimizing uncertainty.

Q41: Roberts Corp. reports pretax accounting income of

Q67: Listed below are five independent situations. For

Q70: On March 31, 2013, MDS, Inc.'s bondholders

Q81: The rate of return on assets indicates:<br>A)The

Q83: At the end of the current year,

Q117: Which of the following statements is true

Q120: Carpenter Gems began the year with a

Q123: Which of the following usually results in

Q126: The par value of common stock represents:<br>A)The

Q160: Pension expense is decreased by:<br>A)Amortization of prior