In LMC's 2018 annual report to shareholders, it disclosed the following information about its income taxes:

INCOME TAXES

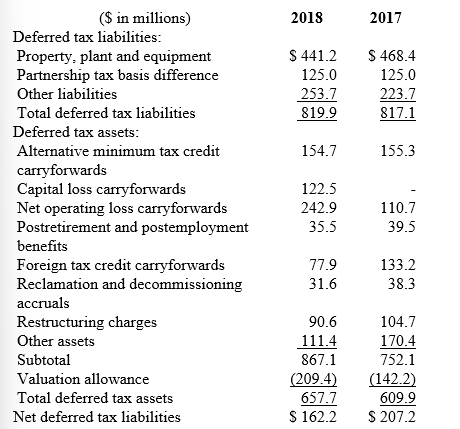

Deferred income taxes reflect the net tax effects of temporary differences between the amounts of assets and liabilities for accounting purposes and the amounts used for income tax purposes.

Significant components of the Company's deferred tax liabilities and assets as of December 31 were as follows:

-Explain why LMC has a $209.4 million valuation allowance for its deferred tax assets.

Definitions:

Surplus

A situation where the quantity of a good or service supplied exceeds the quantity demanded at a given price, often leading to price reductions.

Demand Schedules

Tabular representations showing the quantity of a good or service that consumers are willing and able to purchase at various prices within a specified period.

Equilibrium Quantity

The quantity of goods or services supplied and demanded at the equilibrium price, where supply and demand curves intersect.

Surplus

A situation where the quantity of a good or service supplied exceeds the quantity demanded at the current price; often leads to price reductions.

Q2: The appropriate asset value reported in the

Q13: Which of the following transactions decreases retained

Q19: On January 1, 2013, Ozark Minerals issued

Q27: On January 1, 2012, WOW amended its

Q35: Required:<br>What amount of interest expense on these

Q79: How do U.S. GAAP and International Financial

Q85: Theodore Enterprises had the following pretax income

Q91: Which of the following causes a permanent

Q118: N Corp. entered into a nine-year capital

Q135: What would the lessee record as annual