In LMC's 2018 annual report to shareholders, it disclosed the following information about its income taxes:

INCOME TAXES

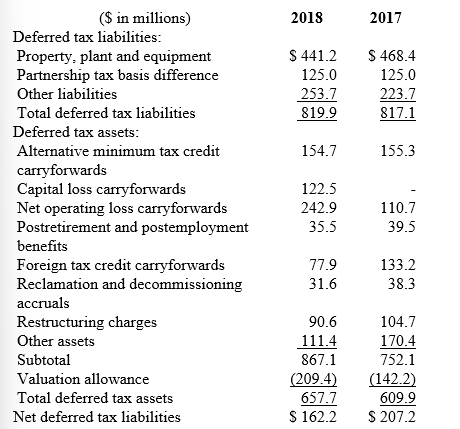

Deferred income taxes reflect the net tax effects of temporary differences between the amounts of assets and liabilities for accounting purposes and the amounts used for income tax purposes.

Significant components of the Company's deferred tax liabilities and assets as of December 31 were as follows:

-Indicate why LMC lists net operating loss carryforwards as a component of deferred tax assets.

Definitions:

Birthday

The anniversary of the day on which a person was born, typically celebrated as an annual event.

Necessary Condition

A requirement that must be met for a statement to be true or for an event to occur; without it, the statement cannot be true or the event cannot happen.

Born

Coming into life or existence.

Speaking Spanish

The act of communicating verbally in Spanish, a Romance language originating from the Castile region of Spain.

Q28: On January 1, 2013, Bishop Company issued

Q49: The preemptive right refers to the shareholder's

Q54: The Kelso Company had the following operating

Q67: What is the 2013 pension expense for

Q79: What was the average price of the

Q94: What should be the balance in Kent's

Q97: Two of the three primary account classifications

Q99: Carolina Consulting Company has a defined benefit

Q112: When a company issues bonds between interest

Q187: Investors should be wary of stock buybacks