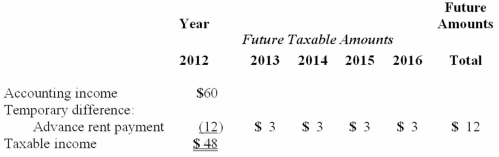

The following information is for James Industries' first year of operations. Amounts are in millions of dollars.  In 2013 the company's pretax accounting income was $67. The enacted tax rate for 2012 and 2013 is 40%, and it is 35% for years after 2013.

In 2013 the company's pretax accounting income was $67. The enacted tax rate for 2012 and 2013 is 40%, and it is 35% for years after 2013.

Required:

Prepare a journal entry to record the income tax expense for the year 2013. Show well-labeled computations for income tax payable and the change in the deferred tax account.

Definitions:

Extinguishes Anxiety

A process or method that effectively reduces or eliminates feelings of anxiety.

Obsession

Persistent, intrusive, and unwanted thoughts or urges that cause distress or anxiety, often seen in obsessive-compulsive disorder.

Biological Theories

Explanations in psychology that attribute complex phenomena such as personality, behavior, and mental disorders to biological factors like genetic, neurological, or evolutionary influences.

Primitive Urges

Basic, innate desires or instincts that motivate behavior.

Q6: What was General's coupon promotion expense in

Q10: On December 31, 2013, the following pension-related

Q11: What was General's coupon promotional expense in

Q13: In each succeeding payment on an installment

Q17: Prior service cost is expensed immediately using:<br>A)U.S.GAAP.<br>B)IFRS.<br>C)Both

Q75: Diablo Company leased a machine from Juniper

Q90: A reconciliation of pretax financial statement income

Q114: On January 1, 2013, Salvatore Company leased

Q128: What was the actuary's interest (discount) rate?<br>A)7%.<br>B)8%.<br>C)9%.<br>D)10%.

Q135: Typical Corp. reported a deferred tax liability