The information that follows pertains to Julia Company:

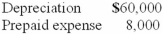

(a.) Temporary differences for the year 2013 are summarized below.

Expenses deducted in the tax return, but not included in the income statement:  Expenses reported in the income statement, but not deducted in the tax return:

Expenses reported in the income statement, but not deducted in the tax return:

Warranty expense 9,000

(b.) No temporary differences existed at the beginning of 2013.

(c.) Pretax accounting income was $67,000 and taxable income was $8,000 for 2013.

(d.) There were no permanent differences.

(e.) The tax rate is 30%.

Required:

Prepare the journal entry to record the tax provision for 2013. Provide supporting computations.

Definitions:

Common Cost

A cost that is not directly attributable to any particular cost object, such as a product, department, or project.

Business Unit

A segment of a company with its distinct operations and management, often treated as an individual entity within the larger corporation for strategic and operational planning.

Avoidable

Something described as avoidable can be prevented or not incurred if certain actions are taken or certain conditions are met.

Performance Report

A document that compares actual results to planned or expected results in areas such as budgeting, operations, and project management.

Q4: Olsson Corporation received a check from its

Q22: The par value of shares issued is

Q47: Patterson Development sometimes sells property on an

Q58: The following selected transactions relate to liabilities

Q72: The Bobo Company leased equipment from Bolinger

Q73: If the lessee and lessor use different

Q89: Required:<br>Explain why the estimated fair value of

Q138: A small stock dividend is defined as

Q146: On August 1, 2014, United Corporation issued

Q149: Consider the following: I. Present value of