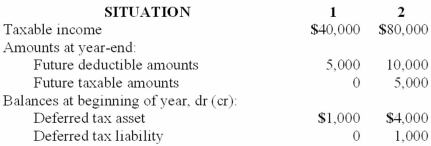

Two independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:  The enacted tax rate is 40% for both situations.

The enacted tax rate is 40% for both situations.

Required:

For each situation determine the:

(a.) Income tax payable currently.

(b.) Deferred tax asset - balance at year-end.

(c.) Deferred tax asset change dr or (cr) for the year.

(d.) Deferred tax liability - balance at year-end.

(e.) Deferred tax liability change dr or (cr) for the year.

(f.) Income tax expense for the year.

Definitions:

Operating Capacity

The maximum output that a company can produce and sell with its existing equipment and resources, without incurring unsustainable costs.

Marble

A metamorphic rock composed primarily of calcite or dolomite, known for its use in sculpture and as a building material.

Long-range Financial Planning

The process of determining a company's financial goals, strategies, and resources over a future period, typically spanning several years.

Analysis

A detailed examination of the elements or structure of something, typically as a basis for discussion or interpretation.

Q1: At the inception of a lease agreement,

Q14: In accounting for operating leases, the lessor,

Q51: Cash dividends become a binding liability as

Q57: A noncancelable lease contains a bargain purchase

Q59: Dharma Initiative, Inc., has a defined benefit

Q77: The rate of return on shareholders' equity

Q115: Suppose that, in 2014, legislation revised the

Q129: Differentiate between guaranteed and unguaranteed residual value

Q150: On October 15, 2013, a 5% stock

Q179: When preferred stock is purchased by the