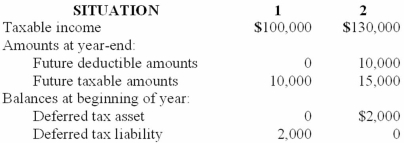

Two independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:  The enacted tax rate is 40% for both situations.

The enacted tax rate is 40% for both situations.

Required:

For each situation determine the:

(a.) Income tax payable currently.

(b.) Deferred tax asset - balance at year-end.

(c.) Deferred tax asset change dr or (cr) for the year.

(d.) Deferred tax liability - balance at year-end.

(e.) Deferred tax liability change dr or (cr) for the year.

(f.) Income tax expense for the year.

Definitions:

Knowledge, Skill

The theoretical understanding (knowledge) and the practical ability (skill) to perform tasks and solve problems.

Ability Demands

The specific skills and competencies required for a job or task, reflecting the necessary capacity to perform effectively.

Self-Initiated Changes

Modifications or transformations that individuals undertake voluntarily in their personal or professional lives to achieve desired outcomes.

Job Demands

Aspects of employment that demand ongoing physical or psychological exertion, including physical, psychological, social, or administrative elements.

Q21: GAAP regarding accounting for income taxes requires

Q77: The rate of return on shareholders' equity

Q81: The rate of return on assets indicates:<br>A)The

Q85: The changes in account balances for Elder

Q103: Stock splits are issued primarily to:<br>A)Increase the

Q114: Show the summary journal entry that Goodday

Q138: What should Kent report as the current

Q157: Each of the four independent situations below

Q160: Share issue costs refer to the costs

Q166: Pug Corporation has 10,000 shares of $10