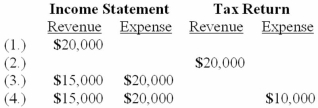

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences reported first on:  Required:

Required:

For each situation, determine the taxable income assuming pretax accounting income is $100,000. Show well-labeled computations.

Definitions:

Customer Relationships

The strategies and techniques businesses use to maintain and enhance interactions and engagement with their customers over time.

Market Share

The percentage of total sales in a market captured by a particular brand, product, or company.

Adapted Quickly

The ability of an individual or organization to respond to changes or challenges in a swift and effective manner.

Direct Marketing

A method of marketing that aims to send promotional messages directly to consumers, bypassing traditional media channels.

Q5: Required:<br>1. Calculate the amount to be recorded

Q21: On June 30, 2013, Blue, Inc., leased

Q24: Classifying liabilities as either current or long-term

Q28: Which one of the following assumptions is

Q43: On January 1, 2013, Salvatore Company leased

Q54: How do U.S. GAAP and International Financial

Q77: Prepayments made on an operating lease are

Q86: Actuary and trustee reports indicate the following

Q120: In its first year of operations, Woodmount

Q144: A contingent loss should be reported in