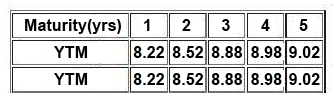

Satish Dhawan, a veteran fixed income trader is conducting interviews for the post of a junior fixed income trader. He interviewed four candidates Adam, Balkrishnan, Catherine and Deepak and following are the answers to his questions. Question 1: Tell something about Option Adjusted Spread Adam: OAS is applicable only to bond which do not have any options attached to it. It is for the plain bonds. Balkishna: In bonds with embedded options, AS reflects not only the credit risk but also reflects prepayment risk over and above the benchmark. Catherine: Sincespreads are calculated to know the level of credit risk in the bound, OAS is difference between in the Z spread and price of a call option for a callable bond. Deepark: For callable bond OAS will be lower than Z Spread. Question 2 : This is a spread that must be added to the benchmark zero rate curve in a parallel shift so that the sum of the risky bond's discounted cash flows equals its current market price. Which Spread I am talking about? Adam: Z Spread Balkrishna: Nominal Spread Catherine: Option Adjusted Spread Deepark: Asset Swap Spread Question 3 : What do you know about Interpolated spread and yield spread? Adam: Yield spread is the difference between the YTM of a risky bond and the YTM of an on-the-run treasury benchmark bond whose maturity is closest, but not identical to that of risky bond. Interpolated spread is the spread between the YTM of risky bond and the YTM of same maturity treasury benchmark, which is interpolated from the two nearest on-the-run treasury securities. Balkrishna: Interpolated spread is preferred to yield spread because the latter has the maturity mismatch, which leads to error if the yield curve is not flat and the benchmark security changes over time, leading to inconsistency. Catherine: Interpolated spread takes account the shape of the benchmark yield curve and therefore better than yield spread. Deepak: Both Interpolated Spread and Yield Spread rely on YTM which suffers from drawbacks and inconsistencies such as the assumption of flat yield curve and reinvestment at YTM itself. Then Satish gave following information related to the benchmark YTMs:  Who amongst the four candidates is correct regarding OAS?

Who amongst the four candidates is correct regarding OAS?

Definitions:

Radial Artery

A major artery in the forearm that supplies blood to the hand and arm, palpable at the wrist.

Bradycardia

A slower than normal heart rate, typically defined as fewer than 60 beats per minute in adults.

Tachycardia

A condition characterized by an abnormally fast heart rate, often defined as exceeding 100 beats per minute in adults.

Heart Rate

The number of heartbeats per unit of time, typically expressed in beats per minute (bpm), indicating cardiovascular fitness and health.

Q9: Modified American Plan (MAP) is also known

Q33: A public area in a hotel that

Q41: When an auditor expresses an adverse opinion,

Q75: The following information pertains to bonds: <img

Q171: Federal legislation has placed the primary responsibility

Q346: The quarterly data required by SEC Regulation

Q351: An auditor most likely would express an

Q453: When performing an engagement to review a

Q696: Which of the following procedures would yield

Q1042: A successor auditor should request the new