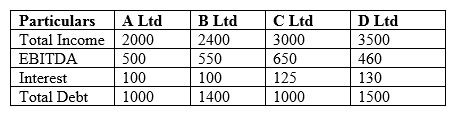

Scott is a credit analyst with one of the credit rating agencies in India. He was looking in Oil and Gas Industry companies and has presented brief financials for following 4 entities:  Two credit analysts are discussing the DM-approach to credit risk modeling. They make the following statements: Analyst A: A portfolio's standard deviation of credit losses can be determined by considering the standard deviation of credit losses of individual exposures in the portfolio and summing them all up. Analyst B: I do not fully agree with that. Apart from individual standard deviations, one also needs to consider the correlation of the exposure with the rest of the portfolio so as to account for diversification effects. Higher correlations among credit exposures will lead to higher standard deviation of the overall portfolio.

Two credit analysts are discussing the DM-approach to credit risk modeling. They make the following statements: Analyst A: A portfolio's standard deviation of credit losses can be determined by considering the standard deviation of credit losses of individual exposures in the portfolio and summing them all up. Analyst B: I do not fully agree with that. Apart from individual standard deviations, one also needs to consider the correlation of the exposure with the rest of the portfolio so as to account for diversification effects. Higher correlations among credit exposures will lead to higher standard deviation of the overall portfolio.

Definitions:

Q40: With regard to the laws and regulations

Q112: The following data pertain to Cowl, Inc.,

Q115: To exercise due professional care an auditor

Q270: An auditor may not issue a qualified

Q387: This question consists of an item pertaining

Q461: An auditor discovered that a client's accounts

Q492: Which of the following is true about

Q507: Which of the following statements should be

Q666: An auditor's primary consideration regarding an entity's

Q757: Which of the following are elements of