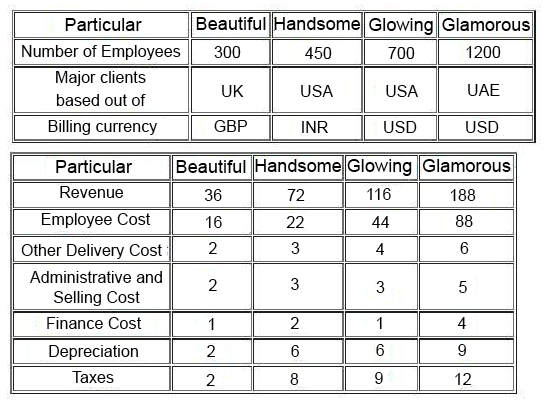

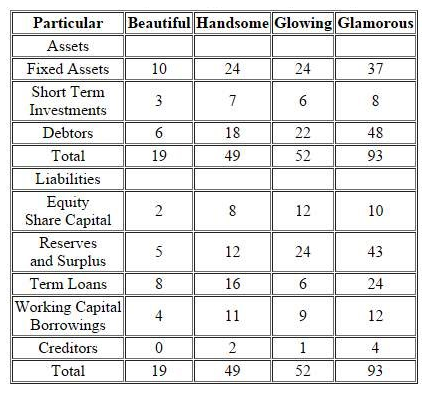

"Following four entities operate in the Indian IT and BPO space. They all are into same segment of providing off-shore analytical services. They all operate on the labour cost-arbitrage in India and the countries of their clients. Following information pertains for the year ended March 31, 201 3.

The year FY13, was typically a good year for Indian IT companies. For FY14, the economic analysts have given following predictions about the IT Industry: A) It is expected that INR will appreciate sharply against other USD. B) Given high inflation and attrition in IT Industry in India, the wages of IT sector employees will increase more sharply than Inflation and general wage rise in country. C) US Congress will be passing a bill which restricts the outsourcing to third world countries like India. While analyzing the four entities, you come across following findings related to Glowing: Glowing is promoted by Mr.M R Bhutta, who has earlier promoted two other business ventures, He started with ABC Entertainment Ltd in 1996 and was promoter and MD of the company. ABC was a listed entity and its share price had sharp movements at the time of stock market scam in late 1990s. In 1999, Mr.Bhutta sold his entire stake and resigned from the post of MD. The stock price declined by about 90% in coming days and has never recovered. Later on in 2003, Mr. Bhutta again promoted a new business, Klear Publications Ltd (KCL) an in the business of magazine publication. The entity had come out with a successful IPO and raised money from public. Thereafter it ran into troubles and reported losses. In 2009, Mr. Bhutta went on to exit this business as well by selling stake to other promoter(s) . There have been reports in both instances with allegations that promoters have siphoned off money from listed entities to other group entities, however, nothing has been proved in any court." What will be impact of on the predictions A and B of the economic analysts, on companies:

The year FY13, was typically a good year for Indian IT companies. For FY14, the economic analysts have given following predictions about the IT Industry: A) It is expected that INR will appreciate sharply against other USD. B) Given high inflation and attrition in IT Industry in India, the wages of IT sector employees will increase more sharply than Inflation and general wage rise in country. C) US Congress will be passing a bill which restricts the outsourcing to third world countries like India. While analyzing the four entities, you come across following findings related to Glowing: Glowing is promoted by Mr.M R Bhutta, who has earlier promoted two other business ventures, He started with ABC Entertainment Ltd in 1996 and was promoter and MD of the company. ABC was a listed entity and its share price had sharp movements at the time of stock market scam in late 1990s. In 1999, Mr.Bhutta sold his entire stake and resigned from the post of MD. The stock price declined by about 90% in coming days and has never recovered. Later on in 2003, Mr. Bhutta again promoted a new business, Klear Publications Ltd (KCL) an in the business of magazine publication. The entity had come out with a successful IPO and raised money from public. Thereafter it ran into troubles and reported losses. In 2009, Mr. Bhutta went on to exit this business as well by selling stake to other promoter(s) . There have been reports in both instances with allegations that promoters have siphoned off money from listed entities to other group entities, however, nothing has been proved in any court." What will be impact of on the predictions A and B of the economic analysts, on companies:

Definitions:

Current Liabilities

Financial duties that must be settled within a year or the standard operational period of the company, classified as short-term.

Payroll Bank Account

A dedicated bank account used exclusively for processing payroll and related transactions, ensuring accurate tracking of wages and taxes.

Times Interest Earned

A financial ratio that measures a company's ability to meet its debt obligations based on its current income, indicating financial health and stability.

Short-term Note Payable

A debt obligation due within a short period, typically less than one year, representing a written promise to pay a specified sum of money.

Q25: Mr. A shares details of two bonds

Q33: Ms. Mary Brown is a credit rating

Q180: With respect to hiring practices, one step

Q182: The Marble Health Plan sets aside a

Q183: One true statement about a health plan's

Q214: Tests designed to detect purchases made before

Q324: Which of the following procedures most likely

Q336: An auditor's report would be designated a

Q383: After fieldwork audit procedures are completed, a

Q538: When a client company does not maintain