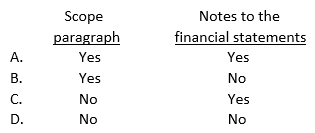

When qualifying an opinion because of an insufficiency of audit evidence, an auditor should refer to the situation in the:

Definitions:

Tax Deductible

Tax deductible refers to certain expenses or investments that can be subtracted from gross income to reduce the amount of income subject to tax.

Depreciation

The allocation of the cost of a tangible asset over its useful life, reflecting the decrease in value due to use and wear and tear.

Income Tax Rate

The percentage at which an individual or corporation is taxed on their income.

Deferred Tax Asset

A financial statement item that represents an entity's right to reduce future tax payments due to temporary differences or certain carryover losses.

Q131: Which of the following procedures most likely

Q161: Which of the following statements is true

Q263: Which option best describes the level of

Q392: An auditor vouched data for a sample

Q468: The use of the ratio estimation sampling

Q558: Proper segregation of duties reduces the opportunities

Q821: For a nonissuer, a previously communicated significant

Q929: Green, CPA, is requested to render an

Q934: In an attest engagement, use of the

Q1033: Baker, CPA, was engaged to review the