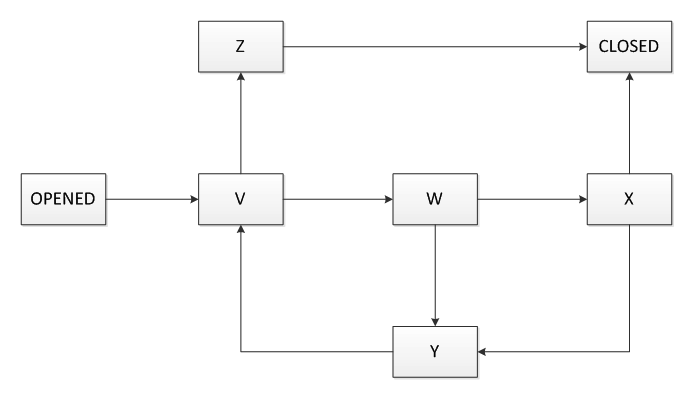

Assume you are working on a defect management process to be used by a software organization to track the current status of the defects reports for several projects. When a defect is found for investigation a defect report is created in "Opened" state that is the unique initial state. The defect report status has also a unique finale state that is the "Closed" state. The following state transition diagram describes the states of this defect management process:  where only the initial ("Opened") and final ("Closed") states are indicated while the remaining states (V, W, X, Y, Z) have yet to be named. Which of the following assignments would you expect to best complete the defect management process? Number of correct responses: 1

where only the initial ("Opened") and final ("Closed") states are indicated while the remaining states (V, W, X, Y, Z) have yet to be named. Which of the following assignments would you expect to best complete the defect management process? Number of correct responses: 1

Definitions:

Payroll Information

Data related to the salaries, wages, bonuses, net pay, and tax deductions of an employer's employees.

Backup Withholding

A form of tax withholding on income for certain types of payments to ensure tax collection on income that may not otherwise be subject to regular withholding.

Taxpayer Identification Number

A unique identifier assigned to individuals and entities by the IRS or Social Security Administration, used for tax purposes.

U.S. Exempt Payee

A category used for certain entities or individuals that are exempt from tax withholding on certain types of income, as specified by the IRS.

Q16: Arrive-and-Go airline wants to clarify its baggage

Q23: You have just been assigned to test

Q32: You are placing two 423 mm (19

Q33: Perimeter raceway systems should be used primarily

Q37: Software Testers in a software development company

Q41: Identify the missing words in the following

Q61: Which is a purpose of the Controlling

Q88: A system holds information about an employee;

Q118: Which of the following approaches is the

Q328: Omnidirectional antennas broadcast equally in all directions