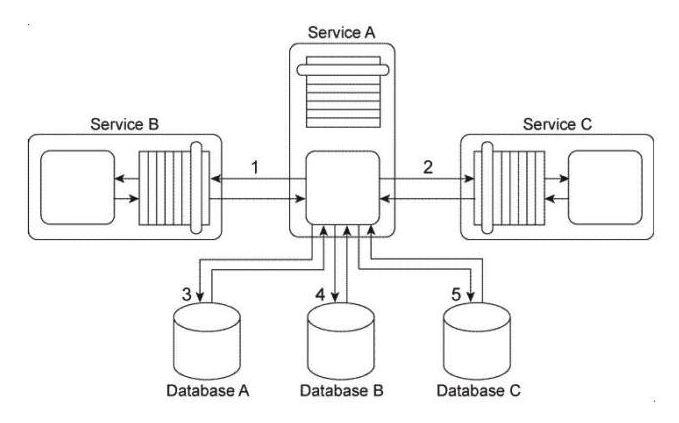

Service A is an entity service that provides a set of generic and reusable service capabilities. In order to carry out the functionality of any one of its service capabilities, Service A is required to compose Service B (1) and Service C (2) and Service A is required to access Database A (3) , Database B (4) , and Database C (5) . These three databases are shared by other applications within the IT enterprise. All of service capabilities provided by Service A are synchronous, which means that for each request a service consumer makes. Service A is required to issue a response message after all of the processing has completed. Depending on the nature of the service consumer request, Service A may be required to hold data it receives in memory until its underlying processing completes. This includes data it may receive from either Service A or Service B or from any of the three shared databases. Service A is one of many entity services that reside in a highly normalized service inventory. Because Service A provides agnostic logic, it is heavily reused and is currently part of many service compositions.  You are told that Service A has recently become unstable and unreliable. The problem has been traced to two issues with the current service architecture. First, Service B, which is also an entity service, is being increasingly reused and has itself become unstable and unreliable. When Service B fails, the failure is carried over to Service A . Secondly, shared Database B has a complex data model. Some of the queries issued by Service A to shared Database B can take a very long time to complete. What steps can be taken to solve these problems without compromising the normalization of the service inventory?

You are told that Service A has recently become unstable and unreliable. The problem has been traced to two issues with the current service architecture. First, Service B, which is also an entity service, is being increasingly reused and has itself become unstable and unreliable. When Service B fails, the failure is carried over to Service A . Secondly, shared Database B has a complex data model. Some of the queries issued by Service A to shared Database B can take a very long time to complete. What steps can be taken to solve these problems without compromising the normalization of the service inventory?

Definitions:

Common Shareholders' Equity

The portion of a company's equity that is attributable to common shares, representing the residual interest in the net assets of the company.

Return on Assets

A profitability ratio that measures how efficiently a company uses its assets to generate profit, calculated by dividing net income by total assets.

Debt to Total Assets

A financial ratio that shows the proportion of a company's assets that are financed through debt.

Basic Earnings per Share

A measure of a company's profitability, calculated by dividing net income by the number of outstanding common shares.

Q7: Identification and documentation of the controls and

Q12: Performance Based Contracting (PBC) helps:<br>A) In vendor

Q25: In which account current, for individual policies,

Q26: What are two NAS file access protocols?

Q35: Query results are stored in the Result

Q41: Which of the following statements is false?<br>A)

Q67: What should be considered when implementing remote

Q68: Which of the processes includes all activities

Q174: Permanent stockholders' equity represents an outside claim

Q204: Direct serving loans method requires a system