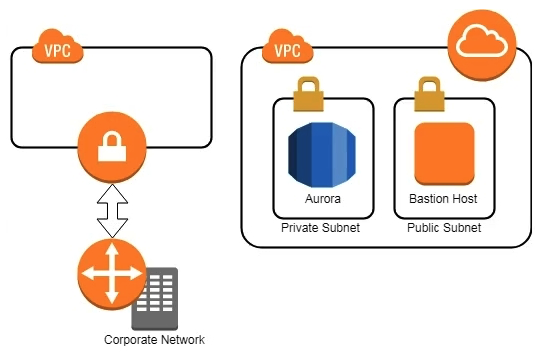

A company has two AWS accounts, each containing one VPC. The first VPC has a VPN connection with its corporate network. The second VPC, without a VPN, hosts an Amazon Aurora database cluster in private subnets. Developers manage the Aurora database from a bastion host in a public subnet as shown in the image.  A security review has flagged this architecture as vulnerable, and a Security Engineer has been asked to make this design more secure. The company has a short deadline and a second VPN connection to the Aurora account is not possible. How can the Security Engineer securely set up the bastion host?

A security review has flagged this architecture as vulnerable, and a Security Engineer has been asked to make this design more secure. The company has a short deadline and a second VPN connection to the Aurora account is not possible. How can the Security Engineer securely set up the bastion host?

Definitions:

Form 1040

The official form provided by the Internal Revenue Service (IRS) that people use to submit their yearly income tax returns.

Wage Bracket Method

A technique used by employers to determine the amount of federal income tax to withhold from employees' paychecks based on their earnings and filing status.

Withholding Allowances

Allowances claimed on employment forms determining the amount of federal income tax withheld from a paycheck.

Federal Withholding

The portion of an employee's wages that is withheld by the employer for the purpose of paying federal income taxes.

Q6: A company is using an AWS Lambda

Q56: A company stores user data in AWS.

Q59: An organization operates a web application that

Q65: A company is using AWS Organizations to

Q98: Machine Learning Specialist is building a model

Q121: A company is developing a report executed

Q272: An operations team has a standard that

Q290: A developer is planning to use an

Q491: A company hosts its multi-tier public web

Q568: A company is hosting a website behind