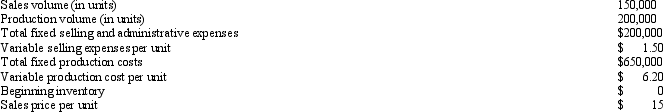

Franklin Company manufactures picture frames. The following information is available for 2011:

Create an income statement for Franklin Company using the variable costing method.

Definitions:

Tax Advantages

Financial benefits that apply to certain investments or accounts, which can reduce the amount of tax owed to the government.

Right of First Refusal

A contractual right that gives its holder the option to enter a business transaction with the owner of something, before the owner is entitled to enter into that transaction with a third party.

Limited Liability

A form of legal protection for shareholders and owners that limits their losses to the amount of investment in the company, protecting personal assets from company debts and liabilities.

Double Taxation

Double Taxation is a tax principle referring to income taxes being paid twice on the same source of earned income. It can occur when income is taxed at both the corporate level and personal level, or in two different countries.

Q7: Gremi Company provides landscaping services to private

Q34: Refer to Exhibit 17-4. The cost of

Q35: Which of the following is not included

Q41: Refer to Exhibit 19-2. Based on

Q56: Which of the following budgets will most

Q69: To prevent quantity variances from being influenced

Q82: Refer to the figure below. Which would

Q89: Another name for the accounting rate of

Q91: The manufacturing overhead account is credited when:<br>A)

Q135: After the break-even point is reached, a