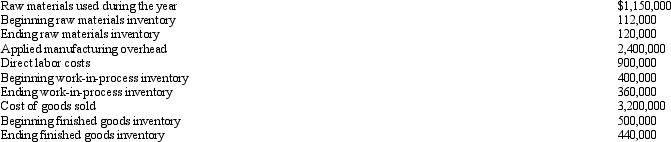

The following end of year information is given for Ashland Company:

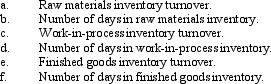

Calculate the following items (assume a 365-day year):

Definitions:

Carrying Amount

Carrying amount, also known as book value, is the value recorded on the balance sheet for a particular asset, reflecting its original cost minus any depreciation, amortization, or impairment costs.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against an asset over its useful life.

Impairment Loss

An impairment loss occurs when the carrying amount of an asset exceeds its recoverable amount, indicating the asset is not expected to generate future benefits worth its recorded value.

Accumulated Depreciation

The total amount of depreciation expense allocated to an asset since it was put into use.

Q9: Define activity-based costing and list the five

Q12: Burke Corporation had accounts receivable of $44,400

Q25: If a corporation has total assets of

Q33: Refer to Exhibit 19-2. Based on the

Q35: If activity-based costing is used, property taxes

Q56: Which entry traces direct materials, direct labor

Q75: Which of the following items is NOT

Q103: Operating leverage deals primarily with the relationship

Q126: Refer to Exhibit 21-8. Area A on

Q135: Comparing the standard variable manufacturing overhead costs